Form 990 is an annual information return that every Nonprofit & tax-exempt organization in the United States must file with the federal agency (IRS). It provides information on the filing organization’s mission, program, and finance. The goal to Form 990 is to ensure transparency and public interest of the tax-exempt organization.

Criteria for Filing Form 990

IRS Form 990 is required to file by every tax-exempt organization categorized under section 501(a). The Form will vary according to the Organization's gross receipts & total assets.

Every Organization must file any one of the required 990 forms even if the Organization is very small.

Variants of Nonprofits Tax Form 990

Form 990-N

IRS Form 990-N is mostly used by small nonprofit and tax exempt organizations with gross receipts less than $50,000. IRS requires this Form to be filed electronically every year. Many Nonprofit organizations may

file 990-N (e-Postcard) form initially and as they grow or change, can file 990-EZ or 990 the next level forms in the next year. Even if the Organization has less than $50,000, it can voluntarily file Form 990-EZ or Form 990 to report their income

and expenses.

Form 990-EZ

Nonprofit tax return is used by organizations with gross receipts less than $200,000 and total assets less

than $500,000.

Form 990

Nonprofit form 990 is used by organizations with gross receipts more than or equal to $200,000 and total assets more than or equal to $500,000.

Form 990-PF

The exempt & taxable private foundations in the United States use the

Form 990-PF.

When is 990 Forms due?

Nonprofit tax Form 990 must be reported on or before the 15th day of the 5th month after the organization's accounting period ends. Usually, May 15th will be the deadline for the organizations that follow the calendar year for their accounting purpose.

What Information Does Nonprofit & Tax Exempt Organization need to Report on Form 990?

- Report the Organization basic details

- Report the organization’s mission or most significant activities,

- Report the organization’s Revenues, and Expenses

- Report the governing body & management details

- Report the Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated Employees, and

Independent Contractors - Provide the Statements Regarding IRS Filings and Tax Compliance

Form 990 is not concluded with these details. You have to include more details when you prepare form 990. You are required to attach even more information about your organization through the list of Schedules.

How to file Form 990 electronically with the IRS?

To avoid the manual work involved in paper filing and to simplify the filing process, IRS is suggesting these nonprofits and tax-exempt organizations to

file their 990 returns electronically.

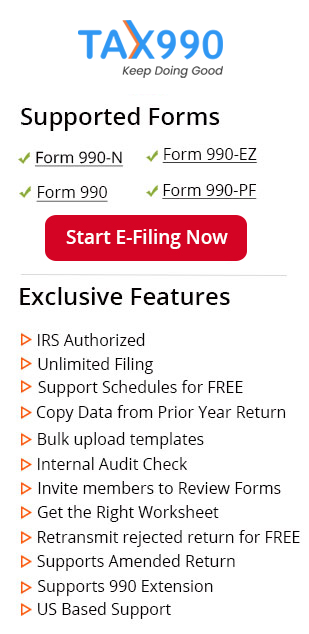

Tax 990 is one of the leading IRS authorized e-file provider for 990 forms which helps nonprofits to stay compliant with its simple and easy to use filing process.

How 1000s of Nonprofits Trusted Tax 990?

- Tax 990 encompasses the highest level of security systems to handle the information more secure way of preventing security vulnerabilities.

- As an IRS Authorized e-file provider, Tax 990 simplifies the IRS 990 filings by offering a user-friendly e-filing experience to complete the tax returns without

any hassle. - Our Software provides an interview-style filing process and helpful tips throughout the entire process.

- You will receive the status of your filing through email or you can check back by signing in to your account any time.

- If your Form gets rejected, Tax 990 will provide you the reason for rejection and let you to retransmit the return for FREE.

- Also, you have the option to correct your previously filed return through the Amended Return feature.

- In order to reduce your time & data entry works in filing your 990 return, we provide a copy return feature where you can use the information that you used to file your form 990 previously.

And the US-Based customer support team helps you throughout the filing process at

any time.

You have even more features that help simplify your 990 filing. Visit tax990.com to know more or to start filing your 990.